Introduction

In a world dominated by rapid digital transformation, market volatility, and monetary policy shifts, one asset class has retained its timeless appeal—gold. Far beyond its traditional role as a symbol of opulence, gold has consistently proven itself as a stabilizing force in modern portfolios. As investors grapple with persistent equity fluctuations and the rise of high-risk digital assets, gold is emerging once again as a critical pillar of financial resilience.

1. Gold Through the Ages: The Original Global Currency

Gold's legacy as a store of value stretches back over 5,000 years. From ancient civilizations using it in trade to its institutional role in the Bretton Woods monetary system, gold has functioned as a universal standard of wealth and trust. Today, it continues to hold a special place in the vaults of central banks and sovereign wealth funds.

Case in Point: The Reserve Bank of India's Strategic Gold Repatriation

The Reserve Bank of India (RBI) has recently initiated the repatriation of a portion of its gold reserves from foreign banks, bringing them back to domestic vaults. This reflects a growing global consensus: in an unpredictable world, physical gold remains a national safeguard.

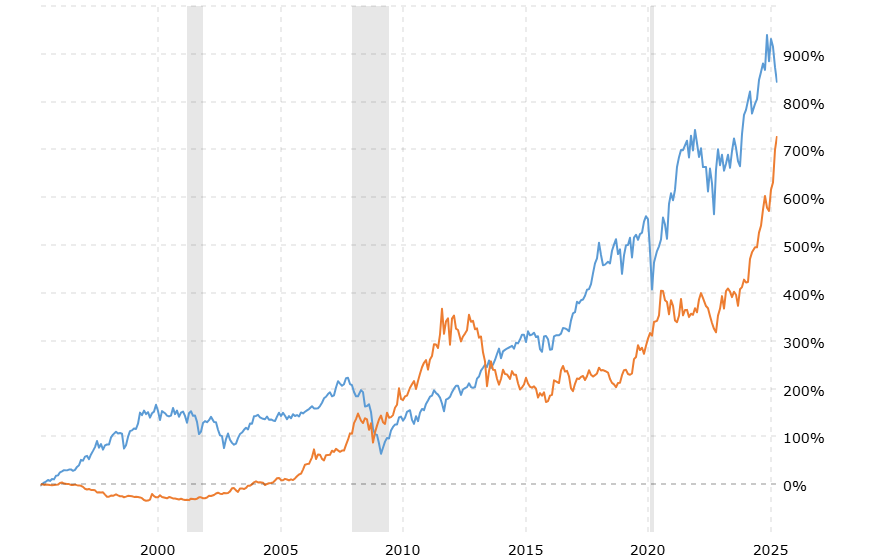

2. Gold vs. Equities: A Comparative Study Since 1995

Chart 1: Performance of Gold vs. Sensex (1995–Present)

- Consistency in Crisis: Gold has proven its value during financial shocks, preserving wealth and providing safety.

- Portfolio Hedge: Gold acts as a counterweight to equities, especially in bear markets.

- Risk-Adjusted Performance: Lower volatility and inverse equity correlation make gold ideal for diversification.

3. Recent Rally: Gold's Momentum in the Last Two Months

Chart 2: Gold Price Movement (Past 60 Days)

- Flight to Safety: The recent surge highlights gold's role as a safe haven during macroeconomic distress.

- Resilience vs. Risk: Gold tends to attract capital when liquidity tightens and fear takes hold.

4. Gold vs. Bitcoin: Comparing Safety and Speculation

Bitcoin, while often touted as "digital gold," displays characteristics more akin to speculative equities. Gold's legacy, low volatility, and central bank backing give it an edge as a defensive asset.

| Factor | Gold | Bitcoin |

|---|---|---|

| Volatility | Low | Extremely High |

| Tangibility | Yes | No |

| Correlation with Equities | Low/Negative | Increasingly Positive |

| Institutional Trust | Backed by Central Banks | Lacks Sovereign Endorsement |

| Crisis Performance | Proven Stability | Unpredictable Behavior |

5. Final Thoughts: Gold as the Guardian of Wealth

Gold may not deliver rapid returns, but it offers something far more valuable—resilience. In uncertain times, it becomes a portfolio's foundation, providing peace of mind and protection.

Whether through physical bars, ETFs, sovereign bonds, or digital platforms, investors today have flexible access to this time-tested asset.

Call to Action:

Are you prepared for the next market shock? Strengthen your financial foundation by allocating a portion of your portfolio to gold. In an era of uncertainty, gold continues to be the asset that not only glitters—but endures.